Part 3 - Is a Real Estate Side Hustle Really worth it?

Running the numbers on STR's purchased at the peak vs purchased in normal times

Welcome everyone!

Last week I discussed the nuances of my experiences with Short Term Rentals, aka AirBnB’s. This week I want to breakdown how STR’s can make or break you, depending on a multitude of factors. Recently I have witnessed many individuals who jumped on the AirBnB train in 2022 and 2023 only to be financially decimated in 2024. There were certain pockets of America that were pushed very hard by realtors local to those areas as “The hottest vacation market around” or “The best location to start your AirBnB business venture”.

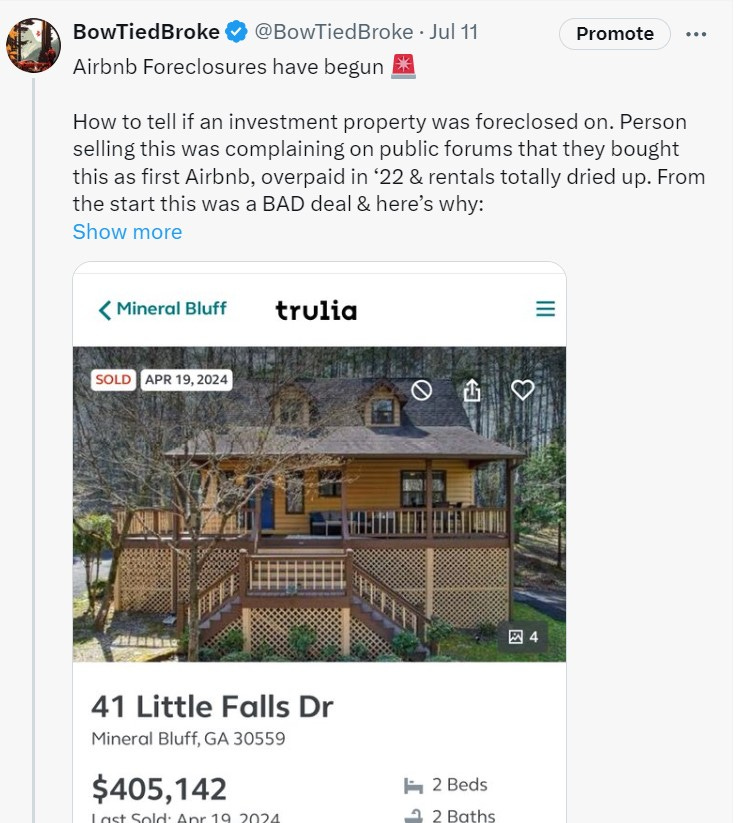

One area that I showcased a foreclosed home in a recent post of mine was Blue Ridge, Georgia. Now, chances are, not many of you have ever heard of Blue Ridge. I had never heard of it before I moved from Florida to Atlanta 15 years ago. I would venture to say with even more confidence that none of you have ever heard of Mineral Bluff, an area in close proximity to Blue Ridge. But, for some reason, this area was pushed as the next great investment opportunity as recently as LAST YEAR!

Growing up pretty poor in the North Florida/South Georgia area, there were certain spots in the Southeast that my parents would take me on vacation when I was a kid. These were the spots in the 70’s and 80’s that you could go to on a budget. Daytona Beach, Panama City, Gatlinburg, TN, Myrtle Beach, SC. Most people, even outside of the Southeast, have heard of these. They have entertainment for parents and adults, stuff for kids to do, lots of attractions, views of the beach or mountains. If I were to break the US into 5 quadrants, the Southeast, Northeast, Midwest, South Central and Pacific, I would venture to say that each quadrant has certain spots like this. Drivable, easy on the wallet and fun. These are places that have been popular to visit for decades and will more than likely be popular vacation destinations for decades to come.

While real estate in these vacation markets skyrocketed over the last 4 years, the problem started when towns that had very little allure road the coattails of the real estate boom, mainly because of their “investment potential”. Much of this proposed potential was pushed in STR groups online, by local realtors and by buyers who were actually making money at that specific time.

A few things happened during Covid that drove demand through the roof for the unheard of vacation destinations.

No one was flying cross country or internationally. From mid 2020 until pretty much early 2022, there weren’t a lot of people flying. International travel dried up, domestic travel from one coast to the other dried up, short one and a half hour flights from FL to NY dried up. As you can see by the worldwide flight data below, it all dried up and took a while to recover.

Kids and parents were sent home. Schools getting shut down and many being forced to work from home caused some families to hit the road, even when it wasn’t the normal summer vacation months. Short quick weeklong “working vacations” spiked. Parents getting antsy being stuck inside with their kids thought “Let’s get on the road and get out of this freaking house!” Mini vacations, where the parents kept working, spiked.

Stimulus Checks - The first of the stimulus checks started arriving shortly after Covid hit. That influx of cash gave some families the extra money needed to hop in their car and take a small vacation that was easy on their wallet.

Ripple effect - While primary vacation markets skyrocketed, there was a major effect on secondary, tertiary and even markets extremely far away from civilization. “Get out of the city!” “Get back to nature!” “Go on a hike, you won’t catch Covid there!” were some of the taglines that drove the demand to visit markets that individuals had never heard of before, let alone ever visited before.

Long Term Rentals (rental property purchased with the goal of setting up annual leases) are pretty cut and dry. You know what your main expense will be each month, the mortgage/taxes. Other than that and any HOA fees you may have, you charge an amount for monthly rent (which hopefully is above your mortgage), collect the check, depreciate the depreciable part on taxes and wait for the sneaky expenses during the year, like the HVAC going out.

Short Term Rentals are a different beast. While neither LTR’s or STR’s are truly passive, LTR’s are usually way more passive than STR’s. Many people self manage their STR. When you see the term “self manage”, that means the owner is handling everything themselves. Bookings, Price per night adjustments, maintenance calls, In the age of electronics and wi-fi, it’s not really difficult to self manage. There are wi-fi keypad Schlage locks for your entry doors, wi-fi Honeywell Thermostats that you can control from 1,000 miles away when your guest leaves the AC on 67 all day in the middle of the summer, booking sites that sync to other booking sites (Airbnb, VRBO, Ownerez) for max exposure and minimum chance of double bookings. There is so much technology available for owners to self manage nowadays that it makes it fairly easy to do so. With self management, an owner eliminates the percentage of Gross Rental that a property management company charges. I have seen these fees vary from 10%-30%. Granted, a property manager handles everything from bookings, to cleanings, to maintenance and you just get the monthly check deposited, but that fee can prove substantial over time. Have a clogged toilet on the weekend? PM gets the call to handle, not you. You get charged for the visit and whatever the cost of the repair may be PLUS their management fee, but for some, not having to field calls or deal with difficult guests makes it worth it.

With the above in mind, a STR can get you sideways financially very fast if you purchase the wrong one. As mentioned above, secondary and further out markets, far away from a primary vacation spot, were marketed and pushed hard starting in late 2020. The party for many of that markets is officially over and many buyers in these markets are feeling the brunt of a high price + high rates + lowered rental demand. That is the trifecta of a bad real estate purchase, especially if the purchase was intended as a cash flowing investment. Let’s dig into the property that I showcased on Twitter recently and run the numbers from two different time periods, the purchase of the property in 2017 for $135,000 and the purchase from 2022 of $432,500.

Let’s run the numbers from 2017. Some of these will be approximations since I don’t have the buyer’s interest rate, monthly expenses, etc. I will be basing their expenses off of STR’s that I have had that are similar size and square feet. There will be a few assumptions like how much they put down, rates, income from rental, but the main goal will be to show you the disparity between two different purchases. A decent purchase that was done in normal times and a FOMO purchase, based on hype, emotion and a trend pushed by every online real estate guru imaginable.

Here are a few data points that I will be using. We will then back into the income or loss of the exact same property at two different times.